Financial Caretaking Plan Overview

The Financial Caretaking Plan addresses the financial management challenges that occur as a person ages. The Plan outlines steps you have taken to prepare for transferring bill paying, investment management, and implementation of the estate plan and the tasks you need to complete to get ready for the day you can no longer manage finances on your own.

When the questionnaire is finished, a customized Financial Caretaking Plan will be generated that includes a personalized checklist of tasks needed to be completed.

How it works

Complete Questionnaire

The questionnaire can be completed on-line on any device. You can save your answers at any time if needed and come back and finish later.

Generate Plan

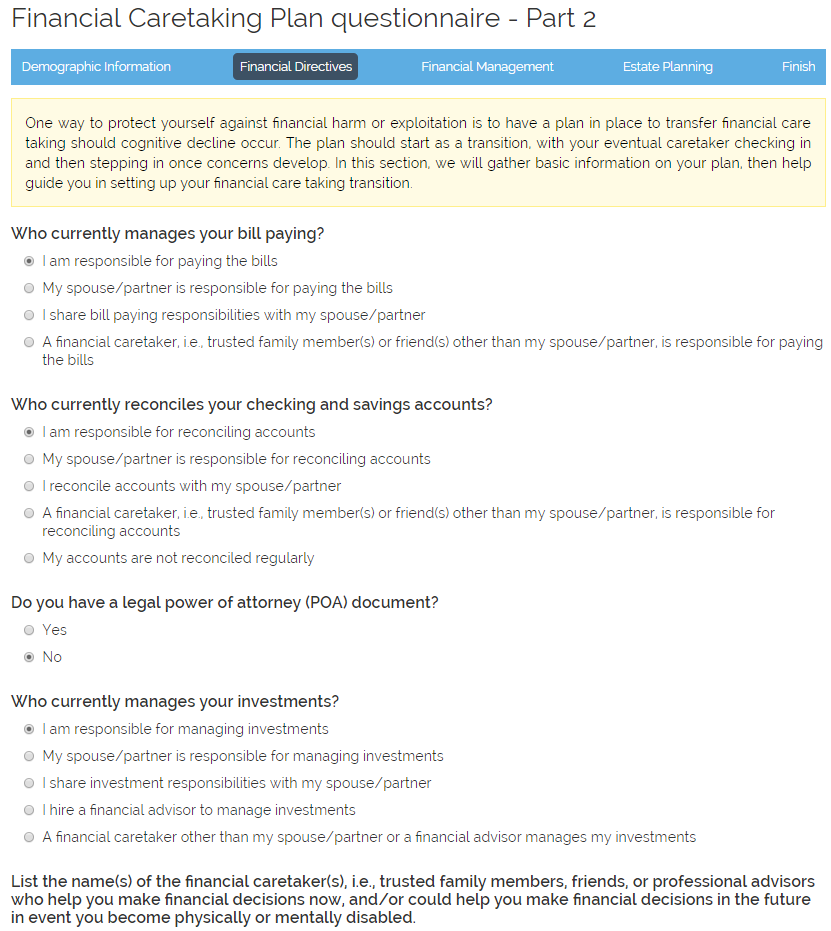

The application generates a personalized caretaking plan that summarizes your financial readiness for aging and includes the names of trusted individuals who can help you make finanical decisions.

Execute Tasks

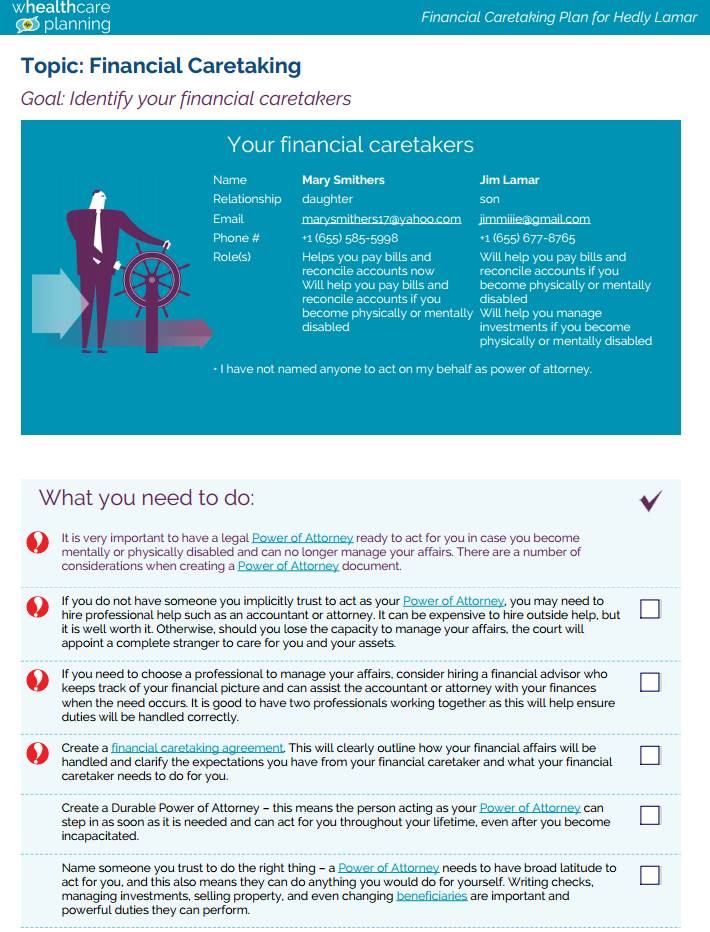

Your financial caretaking plan includes a prioritized list of tasks. The tasks can be copied and pasted into other programs, including Word, Outlook, your CRM, or a personal financial management software application.

Learn More

Hyperlinks to our Whealthcare Education Center are provided within the plan that enable you to drill down on more complex topics and view instructions on tackling complicated tasks.

Introducing Financial Caretaking Planning to Your Clients

"When you are presenting financial caretaking planning as something the client needs to do, it doesn't need to be shrouded in secrecy", advises Carolyn McClanahan, MD, CFP and director of financial planning at Life Planning Partners in Jacksonville, Florida and Co-Founder of Whealthcare Planning LLC. "When you are comfortable talking about [sensitive] issues with your clients, they become comfortable talking about them with you."

Watch this short video to hear more about how Carolyn introduces the concept of financial caretaking to her clients.

Completing the Questionnaire

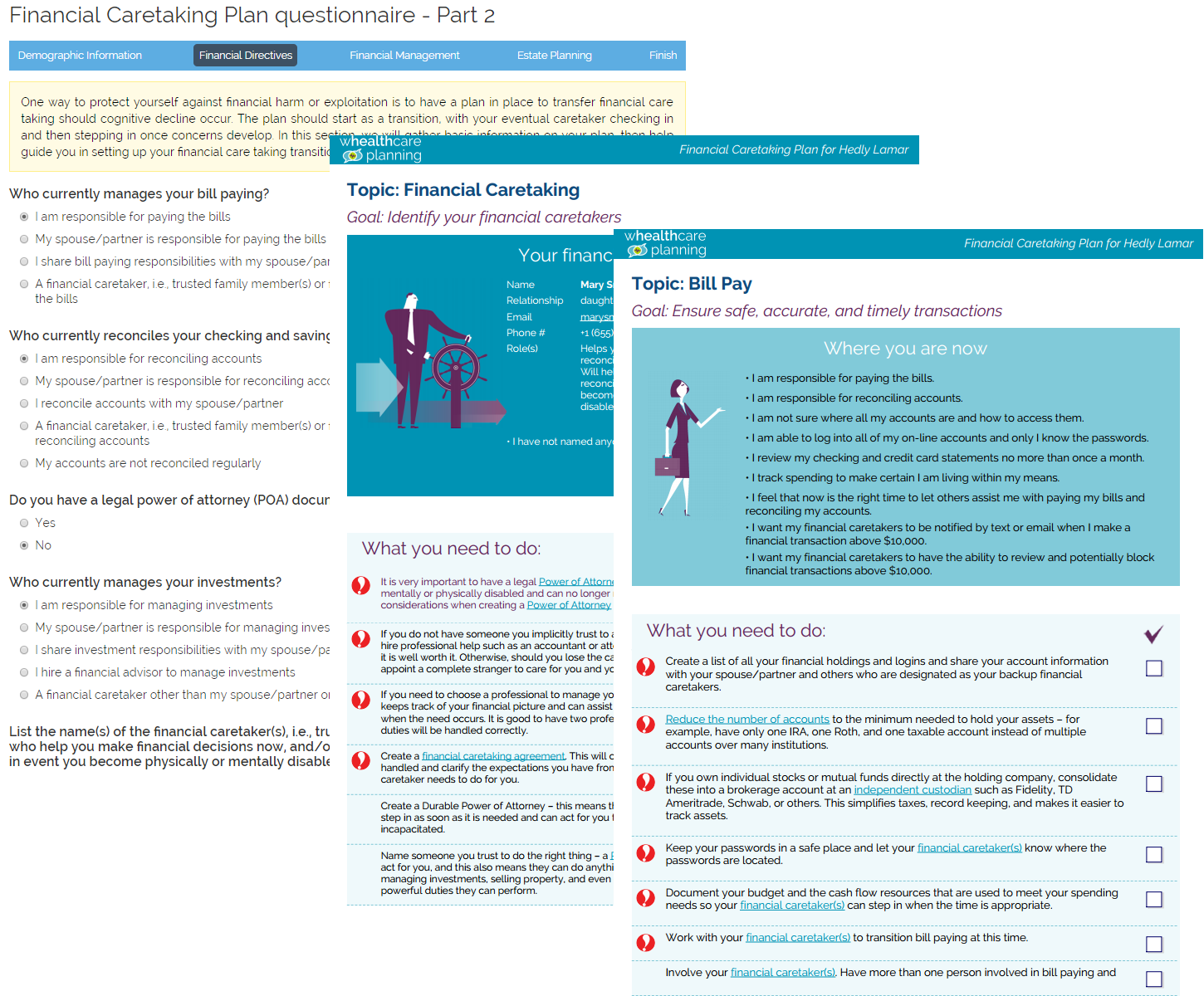

The Financial Caretaking Plan questionnaire contains 30 questions, and takes only about 15 minutes to complete. The questionnaire is designed to collect information on your "trusted contacts", i.e., family members or friends who can help you with financial decisions in case of a medical emergency. The questionnaire also determines your current level of involvement in making financial decisions, guides you in setting up your financial caretaking transition, and collects important estate planning information.

The application always remembers the answers to all questions that have previsouly been answered. If needed, you can save a partially completed questionnaire and come back later and finish.

The questionnaire can be completed by your client or any member of his or her family, i.e., father, mother-in-law, grandmother, etc. Your client can take the questionnaire in your office or you can email them a link so they can complete the questionnaire at home.

Using the Financial Caretaking Plan Questionnaire With Your Client

When a client is filling out the questionnaire, "you want to make certain that they list everybody who is important in their lives that may have anything to do with money, not just their powers of attorney", advises Carolyn McClanahan, MD, CFP and director of financial planning at Life Planning Partners in Jacksonville, Florida and Co-Founder of Whealthcare Planning LLC.

Watch this short video to hear more of Carolyn's recommendations for completing the Financial Caretaking Plan questionnaire.

Financial Caretaking Plan and Task List

Once the questionnaire has been completed, the application generates a customized Financial Caretaking Plan. The Plan will be different for each client, depending how they answered the questions. The Plan is available in 2 formats: PDF and Microsoft Word. Both documents reside in your system, and are available from your dashboard. The Plans never expire and can only be deleted by the user. Your clients will not have direct access to the Plan, and it is up to you how you want to share the information in the Plan with your client.

To update a Plan, on your dashbaord, simply click the "update" icon next to the name of the Plan for the client you want to update. The application keeps your previous answers and you only need to change the answers to those questions that need to be updated.

Once you save your new answers, a new Plan will be generated. The previous Plan will no longer be avialble on the system, so if for some reason you want to keep an older version of a Plan, download the existing Plan to your computer before changing your answers.

Implementing the Financial Caretaking Plan

The Plan includes a personalized checklist of tasks needed to be completed. "Once you have a Financial Caretaking Plan completed, it's going to give your client a fairly significant list of things to do. We download the report as a Word document and cut and paste the tasks into our CRM.", explains Carolyn McClanahan, MD, CFP and director of financial planning at Life Planning Partners in Jacksonville, Florida and Co-Founder of Whealthcare Planning LLC.

Watch this short video to hear Carolyn's recommendations for implementing Financial Caretaking Plan tasks.