Proactive Aging Plan Overview

The Proactive Aging Plan establishes your living preferences, quality of life directives, and attitudes towards medical treatment. It incorporates these factors, along with life expectancy, health status, and region, to generate customized health care cost estimates, including long-term care cost scenarios.

When the questionnaire is finished, a customized Proactive Aging Plan will be generated that includes personalized health care cost estimates and a customized task list.

How it works

Complete Questionnaire

The questionnaire can be completed on-line on any device. You can save your answers at any time if needed and come back and finish later.

Estimate Health Costs

The application generates personalized retirement health care cost estimates, including long-term care costs. It also provides recommendations for controlling health care costs.

Plan for Transitions

The application generates a personalized life transitions plan, including checklists and recommendations for living and driving transitions.

Learn More

Hyperlinks to our Whealthcare Education Center are provided within the plan that enable you to drill down on more complex topics and view instructions on tackling complicated tasks.

Whealthcare Planning co-founder and InvestmentNews 2018 industry innovator award winner Carolyn McClanahan, MD, CFP, explains how to create and implement a Procative Aging Plan.

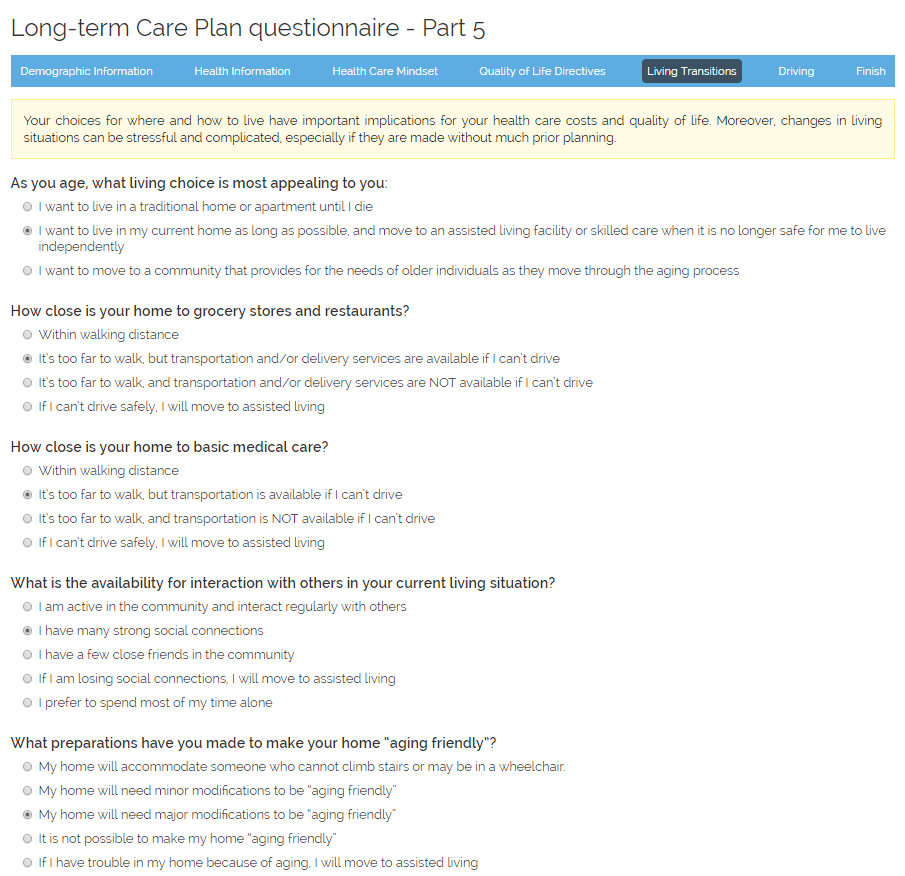

Completing the Questionnaire

The Proactive Aging Plan questionnaire contains 60 questions, and takes about 20 minutes to complete. The questionnaire is designed to collect information about your living and driving preferences, health care mindset, health care status, and advanced directives. Importantly, the questionnaire identifies levers - like living preferences and attitudes towards medical treatment - that enable you to control the costs of your health care and long-term care.

The application remembers the answers to all questions that have previously been answered. If needed, you can save a partially completed questionnaire and come back later and finish.

The questionnaire can be completed by you or any member of your family, i.e., father, mother-in-law, grandmother, etc.

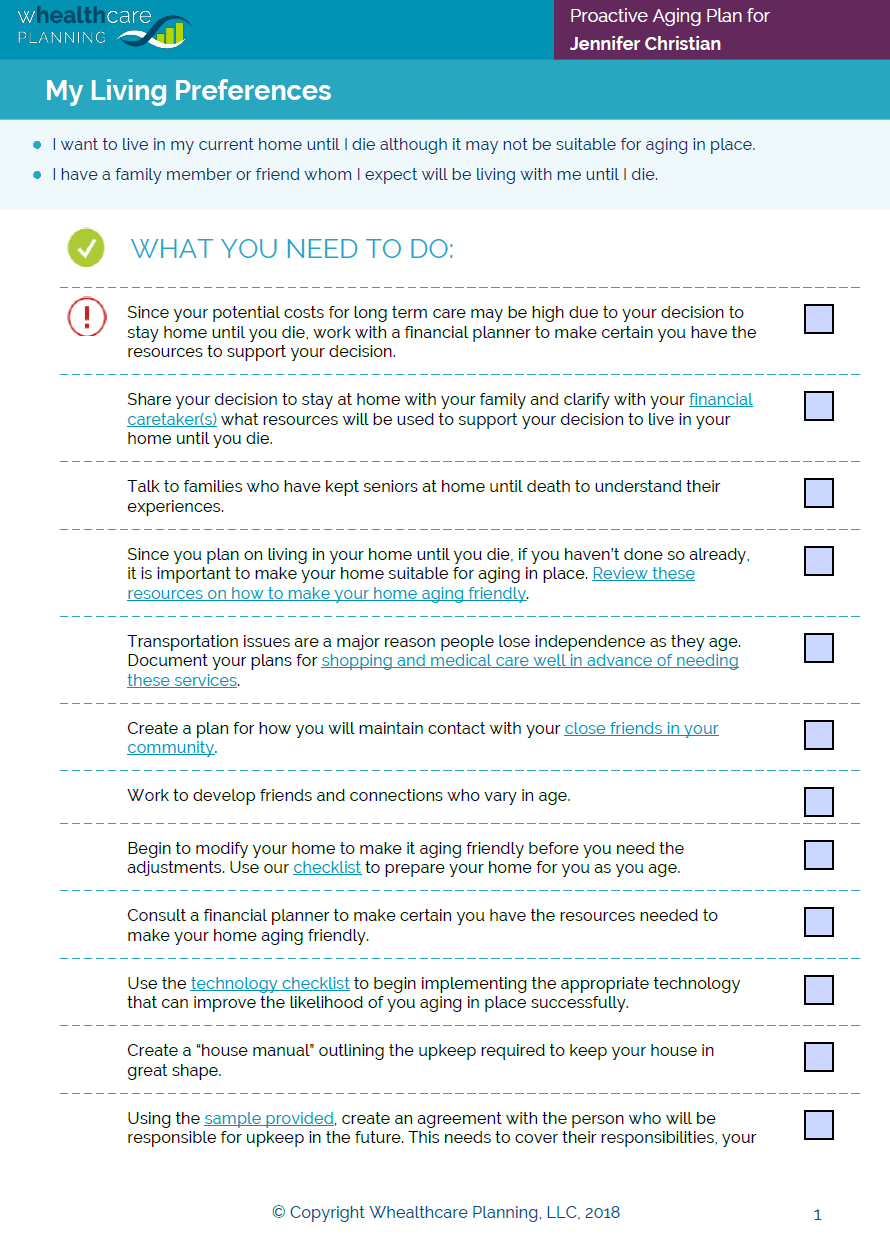

Proactive Aging Plan and Task List

Once the questionnaire has been completed, the application generates a personalized Proactive Aging Plan. The Plan is available in 2 formats: PDF and Microsoft Word. Both documents are available from your dashboard. The Plans never expire and can only be deleted by the user.

The Plan contains health care costs estimates in retirement, including long-term care costs, as well as a list of customized tasks. You can copy and paste the tasks from the Word document version of the Plan and enter them into another document if you want.

To update a Plan, on your dashboard, simply click the "update" icon next to the name of the Plan for the person you want to update. The application keeps your previous answers and you only change the answers to those questions that need to be updated.

Once you save your new answers, a new Plan will be generated. The previous Plan will no longer be avialble on the system, so if for some reason you want to keep an older version of a Plan, download the existing Plan to your computer before changing your answers.

Health Care Cost Estimates

For many people, health care costs in retirement, including long-term care costs, represent a sizable fraction of total expenses. Unfortunately, most people do not have a good sense for what those expenses are. Moreover, people often do not understand the ways in which they can control these costs.

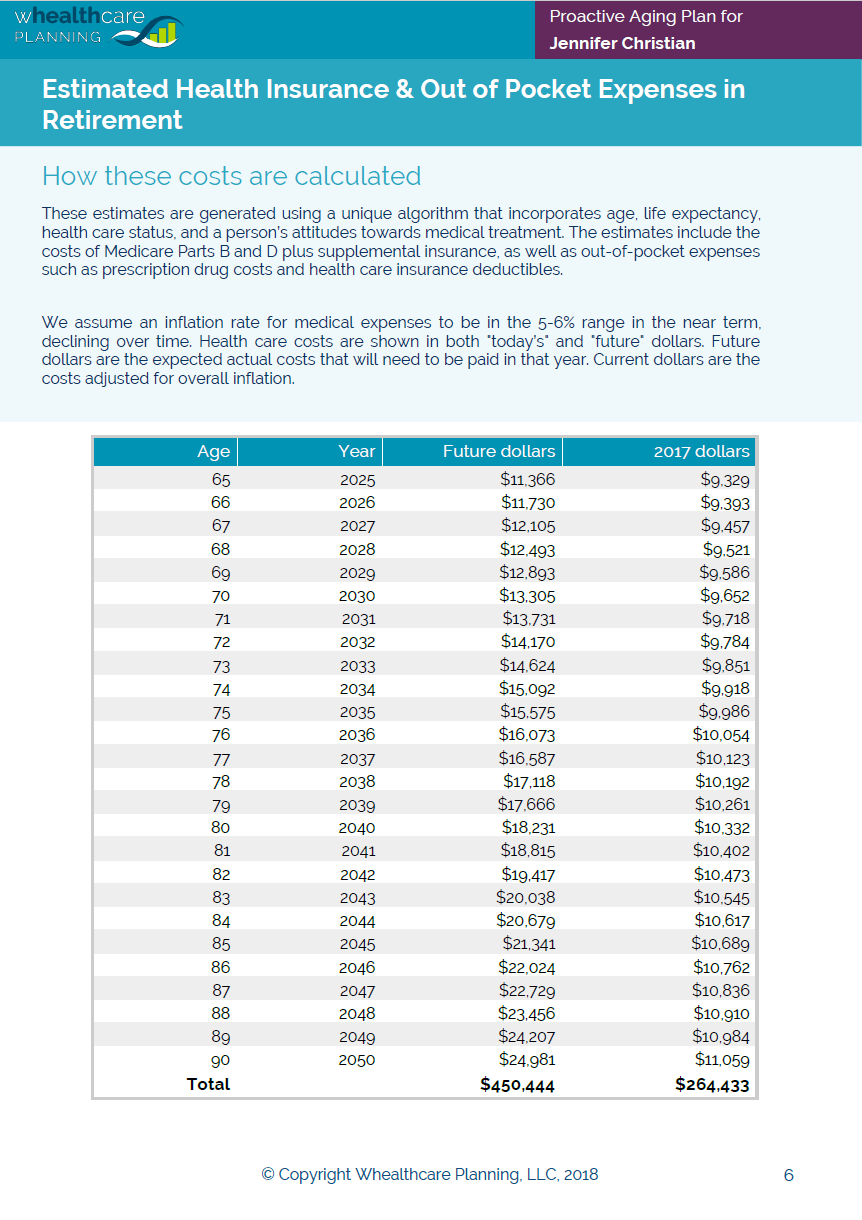

Using a unique algorithm that incorporates current age, life expectancy, health care status, and attitudes towards medical treatment, the application generates personalized health care costs estimates in retirement. These projections include the costs of Medicare Parts B and D plus supplemental insurance, as well as out-of-pocket expenses such as prescription drug costs and health care insurance deductibles.

These health insurance and out-of-pocket expense estimates can be easily copied from the Word or PDF versions of the Plan into Excel or a financial planning software application.

How Costs Are Calculated

We start by estimating life expectancy. Using the questionnaire respondent's current age and gender, we calculate his or her average life expectancy based on tables provided by the US Social Security Administration. We then adjust this estimate using additional information provided by the respondent concerning their current health status. Specifically, using the a person's weight and height, we calculate their body mass index. We also score their answers concerning tobacco and alcohol usage, diet, current health status, activity level, and degree of socialization. Using these answers, we adjust the life expectancy up or down. People who eat a healthy diet, exercise frequently, do not use tobacco products, and socialize frequently are expected to live longer than average, while those who use or have used tobacco, consume large quantities of alcohol, and do not exercise are not expected to live as long.

All respondents have the ability to change their life expectancy if they do not agree with the value that the application generates. For example, some financial planners like to use 100 as a life expectancy to help ensure that their clients have enough savings to provide for a long life.

Using a person's current age and life expectancy, we calculate the number of years during retirement (defined as starting at age 65) that health care costs will be incurred. For example, if life expectancy is 85, we estimate health care costs each year for the respondent between the ages 65 and 85. This constitutes the "baseline" health care cost estimate for each individual. Baseline costs in the current year are generated from existing public sources of information about average health care costs in the United States, and then adjusted for inflation to generate future costs estimates. We assume an inflation rate for medical expenses to be in the 5-6% range in the near term, declining over time.

Because individuals use the health care system differently, we make adjustments to the baseline average costs based on the respondent's expected level of health care utilization. Our health care estimates include the cost of basic medical coverage plus out-of-pocket expenses for deductibles and prescription drugs. "High" health care users are expected to spend more in these areas than "low" health care users. Using the questions in the "Health Care Mindset" section of the questionnaire, we attempt to assess the respondent's expected level of health care utilization. For example, a person who has a chronic disease like diabetes, makes frequent trips to the doctor's office, seeks second and third opinions, uses complementary care such as chiropractors or message therapists, and pursues experimental therapies will have higher costs than average. Conversely, healthy individuals who rarely go to the doctor, do not have a chronic disease, and do not use complentary medical services will likely have lower health care costs than average.

Health care costs in the table in the report are shown in both "current" and "future" dollars. Future dollars are the expected actual costs that will need to be paid in that year. Current dollars are the costs adjusted for overall inflation (using the US Consumer Price Index, or CPI). Above the table we also show the total costs that will be incurred (in dollars denominated in that year) starting in the year that the person turns 65. For example, if the person turns 65 in the year 2025, the total cost of health care is shown in 2025 dollars. We expect overall inflation as measured by the CPI in the near-term to be roughly 2%, rising slightly over time.

It is possible to use the application to run multiple health care costs "scenarios" using different life expectancies, e.g., age 90, age 95, etc. See the FAQ for an explanation.

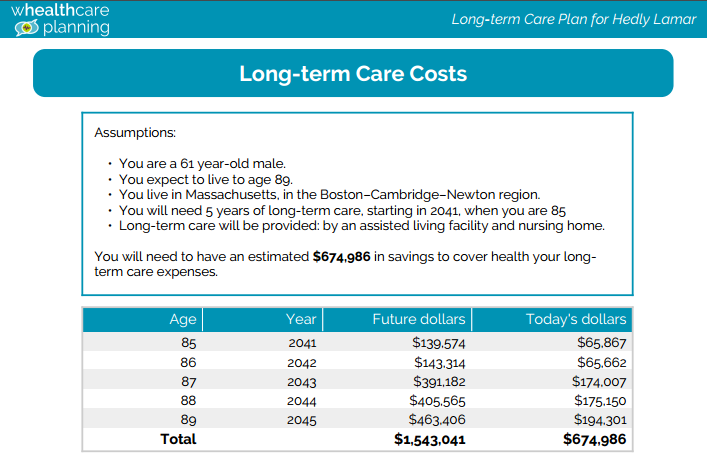

Long-term Care Cost Estimates

Long-term care costs include a range of medical, social, and housing services designed to support the needs of people living with chronic health problems that affect their ability to perform everyday activities. Our estimates assume that everyone will incur some long-term care costs at the end of their lives. The length and type of long-term care is determined by a complex algorithm that takes into consideration living preferences, health status, geographic region, and life expectancy.

These long-term care cost estimates can be easily copied from the Word or PDF versions of the Plan into Excel or a financial planning software application.

How Costs Are Calculated

We start by estimating life expectancy. See the explanation in the "Health Care Costs" tab on this page.

We then estimate the number of years for which the questionnaire respondent will require long-term care. This calculation is based on the person's health status as measured using their answers to the questions in the "Health Information" section of the questionnaire. For example, using a person's weight and height, we calculate their body mass index. We also score their answers concerning tobacco and alcohol usage, diet, current health status, activity level, and degree of socialization. We use these answers to generate an overall health score.

We then assume that healthy individuals will live longer and require more years of long-term care, while unhealthy individuals will not live as long and require fewer years. Specifically, healthy individuals are projected to require 5 years of long-term care, individuals in average health 3 years, and unhealthy individuals 2 years.

In the next step we calculate the type of long-term care that will be required, e.g., assisted living, nursing home, home health care services, etc. This determination is based largely on the answers provided in the "Living Transitions" section of the questionnaire. For example, a person who wants to stay at home will incur charges for home health aide services, homemaker services, and (if the respondent has a family member living with them) adult day care services. A person who chooses to live in an assisted living facility will incur costs for assisted living and nursing home facilities. For these repondents, we assume two years of assisted living and one year nursing home (for those in average health) and two years of assisted living and three years in a nursing home (for healthy individuals). Individuals requiring only two years of long-term care outside of the home are expected to spend these years in a nursing home.

We also make adjustments for region of the country, based on the respondent's answer about where he or she expects to retire. Costs for assisted living, nursing home facilities, and home health aide service vary across the country, so we want to be sure to capture those differences. Also, we expect demographic shifts over time within the US to have an impact on regional costs factors. Faster growing regions in the South and West are expected to see faster growth in costs than slower growing regions in the Northeast and Midwest.

We start by using publicly available sources for the various long-term care costs by region. We then create projections for future costs using 1) inflation rates of between 1-3% for the different types of care, and 2) adjustments based on US population growth rates by state as estimated by the US Bureau of Labor Statistics. We then use these by region/by type cost estimates in our calculations of long-term care costs.

We make one final adjustment for end of life decision-making. If the respondent either does not have advanced directives in place that have been shared with their family or he or she prefers to be kept alive as long as possible even if they have a terminal condition, they will most likely experience increased out of pocket costs at the end of life. The average extra money spent in the last year of life without advanced directives is $18,000 in today's dollars. We add this costs (adjusted for inflation) in the last year of life if the respondent does not have directives of prefers to be kept alive as long as possible with a terminal condition.

Long-term care costs in the table in the report are shown in both "current" and "future" dollars. Future dollars are the expected actual costs that will need to be paid in that year. Current dollars are the costs adjusted for overall inflation (using the US Consumer Price Index, or CPI). Above the table we also show the total costs that will be incurred (in dollars denominated in that year) starting in the year that long-term care begins. For example, if long-term care begins in the year 2025, the total cost of long-term care (over 2, 3 or 5 years) is shown in 2025 dollars. We expect overall inflation as measured by the CPI in the near-term to be roughly 2%, rising slightly over time.

It is possible to use the application to run multiple long-term care costs "scenarios" using different life expectancies, e.g., age 90, age 95, etc. See the FAQ for an explanation.