Whealthcare Risk Profile Overview

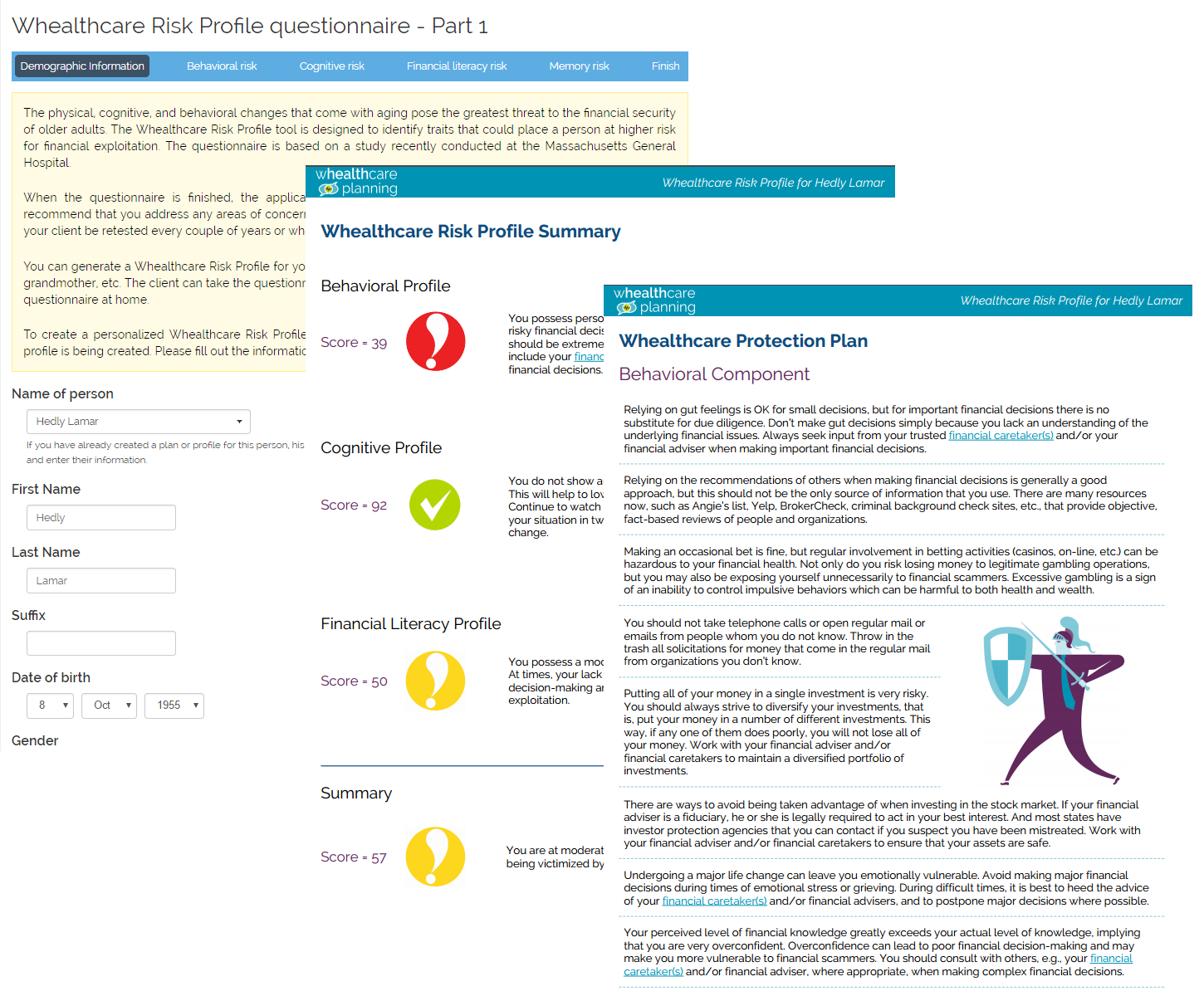

The Whealthcare Risk Profile tool is designed to identify traits that could place a person at higher risk for financial exploitation. The questionnaire is based on a study recently conducted by the Massachusetts General Hospital on the relationship between aging, cognitive impairment, and financial decision-making.

When the questionnaire is finished, a customized Whealthcare Protection Plan will be generated that includes a personalized the results of your behavioral screen.

How it works

Complete Questionnaire

The questionnaire can be completed on-line on any device. We recommend you complete this assessment after finishing the Financial Caretaking Plan questionnaire.

Generate Risk Score

The application generates a personalized Whealthcare Protection Plan, which includes a Whealthcare Risk score, indicating your level of risk for financial exploitation.

Monitor Changes

If the results show cause for concern, we recommend discussing with family members and/or your financial caretakers. If not, continue to monitor for any changes in behavior.

Revisit and Repeat

We recommend that you re-take the questionnaire every two years, or if any significant changes in behavior occurs.

The Whealthcare Risk Profile questionnaire is not a test for dementia or cognitive decline – it simply helps ascertain if your client has an increased risk for fraud and abuse. It provides a baseline of their financial decision making tendencies for the future.

How to Handle the Whealthcare Risk Profile Results

"A great benefit of using this tool is the possibility of catching [diminshed capacity] early," advises Carolyn McClanahan, MD, CFP and director of financial planning at Life Planning Partners in Jacksonville, Florida and Co-Founder of Whealthcare Planning LLC.

Watch this short video to hear more of how to manage Whealthcare Risk Profile results.

Clinical Study Results

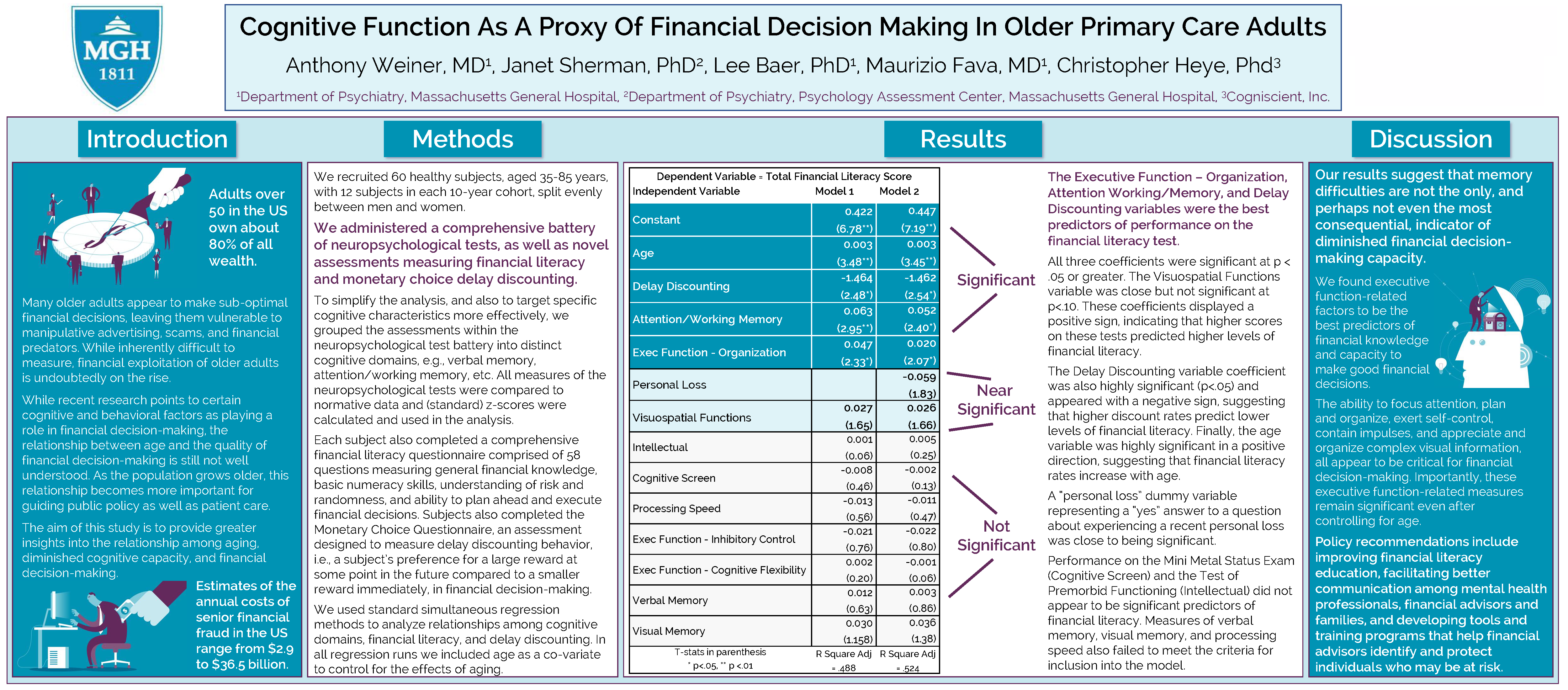

The Whealthcare Risk Profile assessment is based on a recently completed clinical study conducted at the Massachusetts General Hospital (MGH) entitled “Cognitive Function As A Proxy Of Financial Decision Making In Older Primary Care Adults”. The study was led by Dr Tony Weiner, Director of Out-Patient Geriatric Psychiatry at MGH and sponsored by Cogniscient, Inc. (one of Whealthcare Planning LLC's parent companies).

The aim of the study was to better understand the relationships among aging, cognitive impairment, and financial decision-making. As part of the study, we administered a unique and comprehensive battery of neuropsychological tests, as well as unique assessments measuring financial literacy and monetary choice delay discounting, to subjects aged 35-85 years.

The study produced important and statistically significant findings. While much of the attention on preventing financial exploitation among the elderly, especially within the financial services industry, has been focused on memory loss, our results suggests that executive function-related deficits are the biggest threats to an individual's capacity to make good financial decisions. The significance of executive-function related capabilities suggests that memory loss is not the only, and perhaps not even the most consequential, indicator of diminished financial decision-making capacity. A person's ability to plan, organize, "connect the dots", and control impulses appears to have highly significant consequences for making good financial decisions and avoiding financial exploitation.

The results of the study were presented by Whealthcare Planning co-founder Chris Heye, PhD at the Alzheimer's Association International Conference in July 2017. A summary of the results have been published in the journal Alzheimer's & Dementia and can be found here.

The full study results will be published in a medical journal sometime in 2018.

Completing the Questionnaire

The Whealthcare Risk Profile assessment contains 24 questions, and takes only about 10 minutes to complete. The questionnaire is designed to screen for behavioral traits – including impulsivity, overconfidence, executive dysfunction, memory loss, and emotional stress – that place at person at risk for poor financial decision-making and financial exploitation.

The questionnaire is based on a study recently conducted at the Massachusetts General Hospital investigating the relationships among aging, diminshed capacity, and financial decision making.

The questionnaire can be completed by your client or any member of his or her family, i.e., father, mother-in-law, grandmother, etc. Your client can take the questionnaire in your office or you can email them a link so they can complete the questionnaire at home.

Unlike the Financial Caretaking and Proactive Aging Plans, none of previous Whealthcare Risk Profile answers are saved.

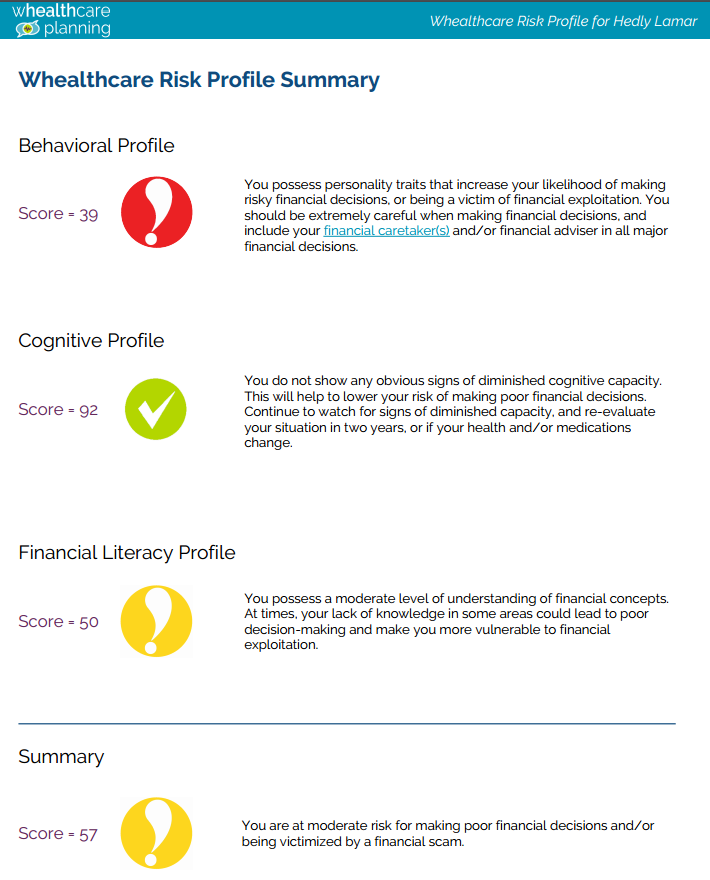

Whealthcare Risk Profile Scoring

Once the questionnaire has been completed, the application generates a personalized risk profile and a protectection plan. The risk profile has 3 major sub-components: behavioral risk, cognitive risk, and financial literacy risk. Each component is scored on a scale 0 to 100 - with lower scores indicating a higher risk of poor financial decision-making. Your Whealthcare profile also contains a summary risk score indicatng your overall level of risk.

Your clients will not have direct access to their scores, and it is up to you how you want to share the information in the Plan with your client.

Whealthcare Protection Plan

The Whealthcare Risk Profile also includes a personalized wealth protection plan. The plan recommendations are based on the speific answers that were provided in the questionnaire.

The Importance of Financial Literacy for Good Decision-making

"The financial literacy section... is a great way for you to find out exactly how much your client know about the basics of finance. Studies show that if people have good financial literacy, it will extend how long they can take care of their financial affairs.", explains Carolyn McClanahan, MD, CFP and director of financial planning at Life Planning Partners in Jacksonville, Florida and Co-Founder of Whealthcare Planning LLC.

Watch this short video to hear Carolyn's recommendations for using the profile scoring as a way to better understand and protect your clients.